Principles of Economics

Principles of economics 9e

by Gregory Mankiw

Chapter 1 Ten Principles of Economics

The word Economy comes from the Greek word Oikonomos, which means "one who magages a household"

Scarcity means that society has limited resources and therefore cannot produce all the goods and services people wish to have.

Economics is the study of how society manages its scarce resources.

In most societies, resources are allocated not by an all-powerful dictator but through the combined choices of millions of households and firms.

Principles:

Decision Making:

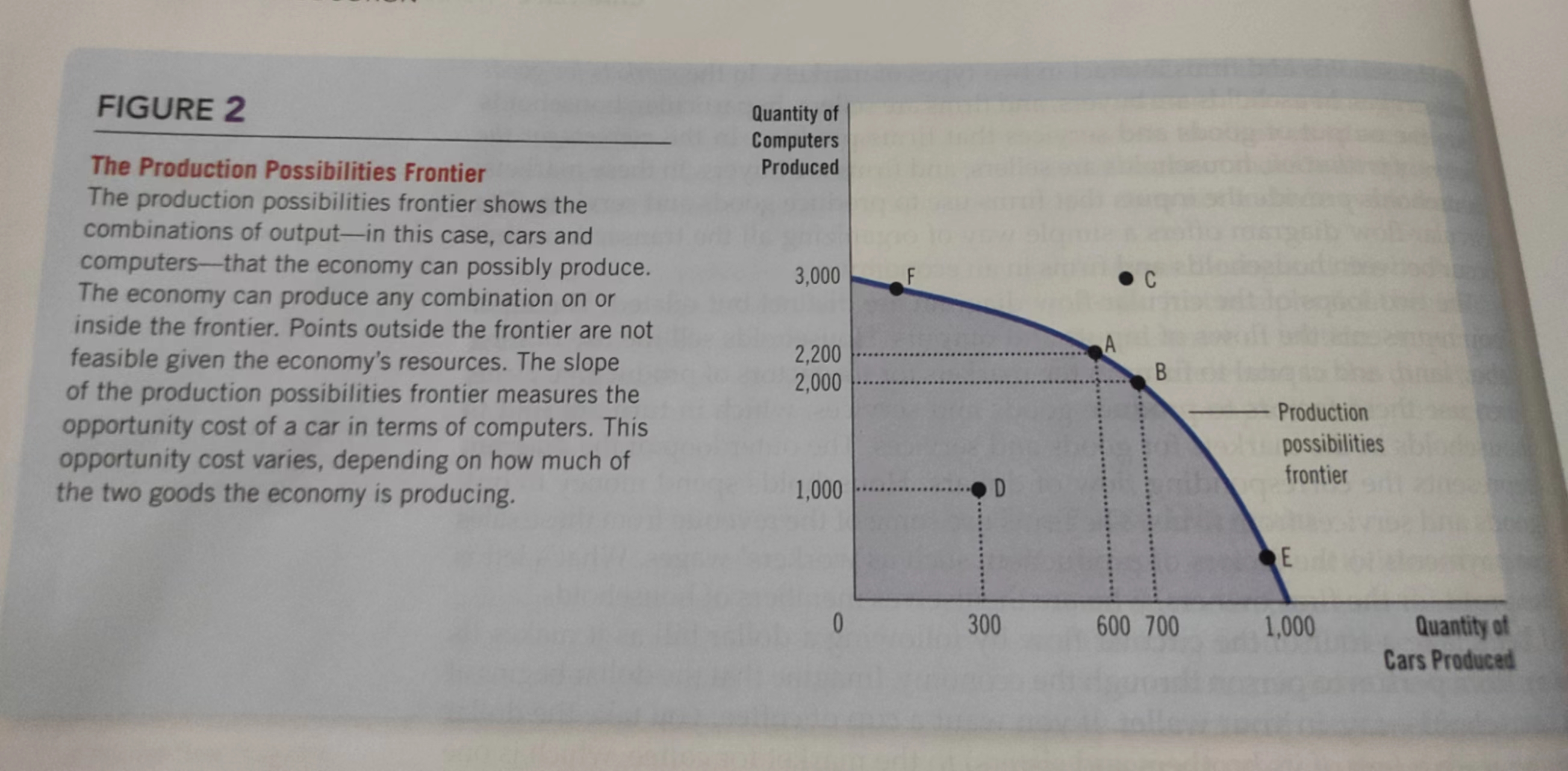

People face trade-offs

"guns and butter"

Efficiency and Equality

The cost of something is what you give up to get it

Opportunity cost: what you give up to get the item

Rational people think at the margin

Marginal change: a small incremental adjustment to a plan of an action

Rational people make decisions by comparing marginal benefits and marginal costs.

People respond to incentives

Incentive is something that induces a person to act.

Seat belt law -> more accidents

How People Interact

Trade can make everyone better off

Markets are usually a good way to organize economic activity

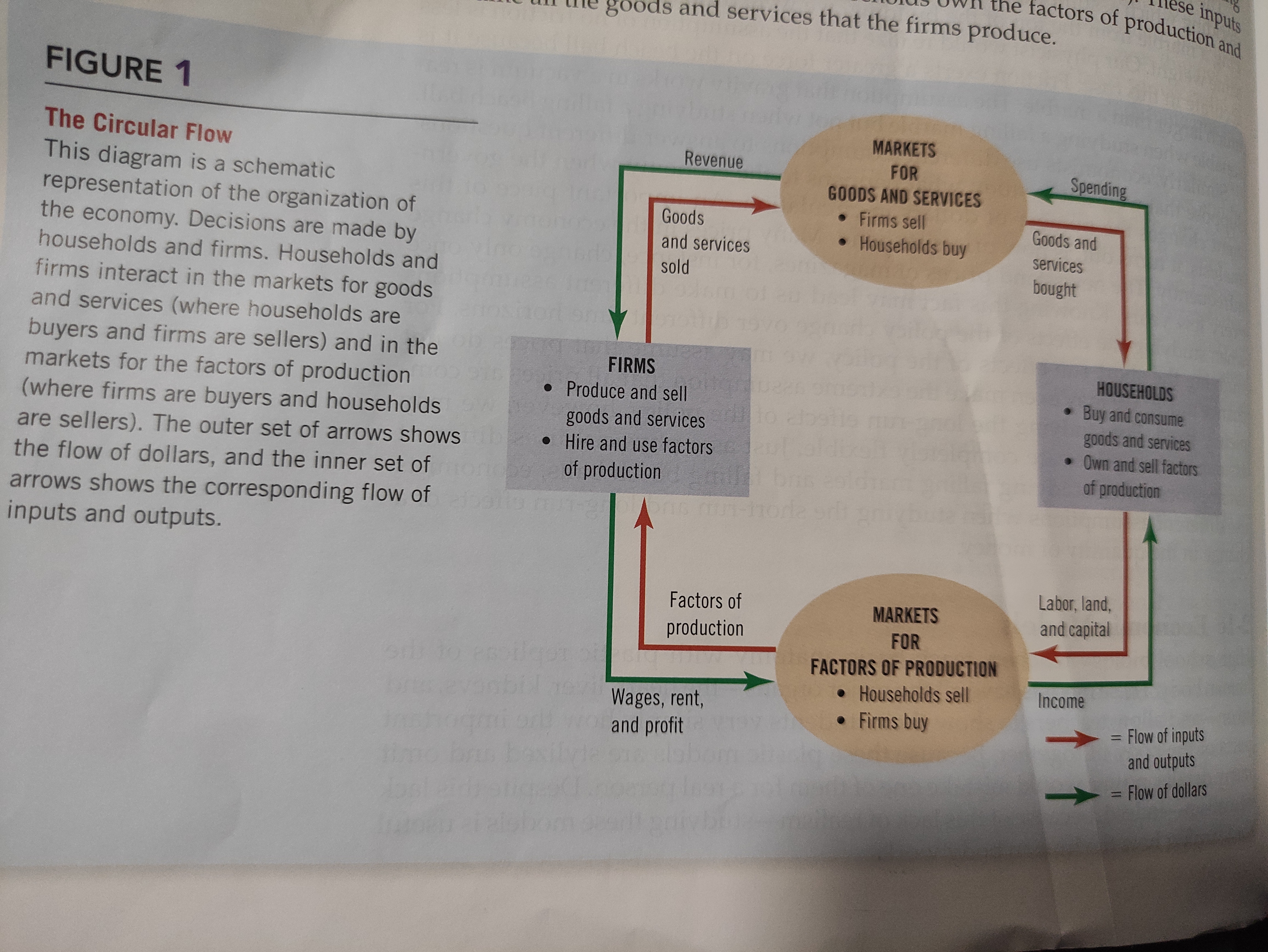

Market economy: An economy that allocates resources through the decentralized decisions of many firms and households as they interact in markets for goods and services

Adam Smith: the invisible hand

Uber

Governments can sometimes improve market outcomes

Property rights The ability of an individual to own and exercise control over scarce resources

Market failure: A market left on its own fails to allocate resources efficiently

Externality: The impact of one person's actions on the well-being of a bystander

Pollution

Market power: The ability of a single economic actor to have a substantial influence on market prices

Monopoly

How the Economy as a Whole Works

A country's standard of living depends on its ability to produce goods and services

Productivity: The quantity of goods and services produced from each unit of labor input

Prices rise when the government prints too much money

Inflation: The increase in the overall level of prices in the economy

1921 Germany

Society faces a short-run trade-off between Inflation and Unemployment

Business Cycle Fluctuations in economic activity, such as employment and production

Chapter 2: Thinking like an Economist

In economics, conducting experiments is often impractical. (Natural experiments offered by history)

Assumptions can simplify the complex world and make it easier to understand.

A economics model is a simplified representation of some aspect of the economy

Circular-Flow Diagram

The Production Possibilities Frontier

Microeconomics

The study of how households and firms make decisions and how they interact in markets

Macroeconomics

The study of economy-wide phenomena, including inflation, unemployment, and economic growth

Microeconomics and Macroeconomics are closely intertwined.

实证表述(positive statement)

Claims that attempt to describe the world as it is

规范表述(normative statement)

Claims that attempt to prescribe how the world should be

Congressional Budget Office

staffed by economists

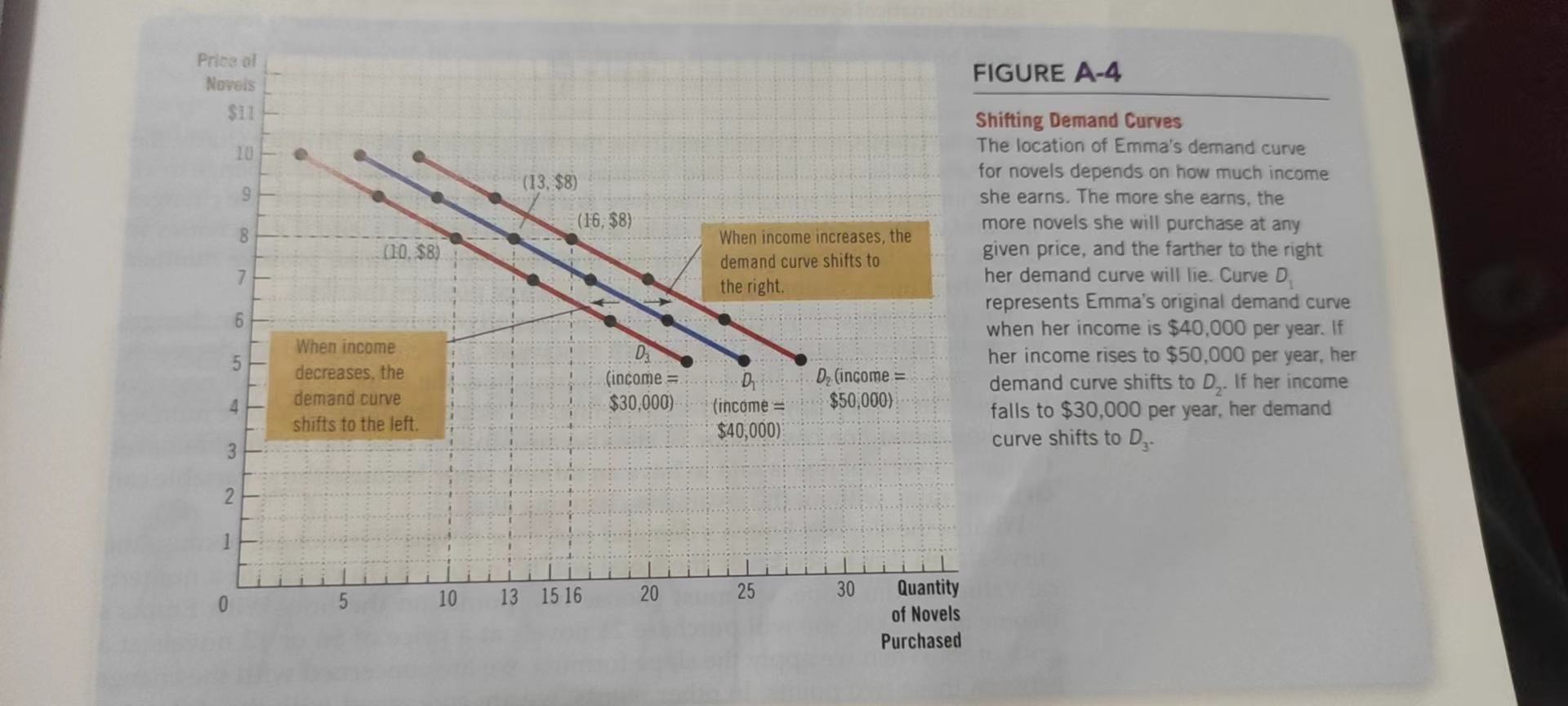

Demand Curve

Chapter 3: Interdependence and the gains from trade

Production Possibilities Frontier

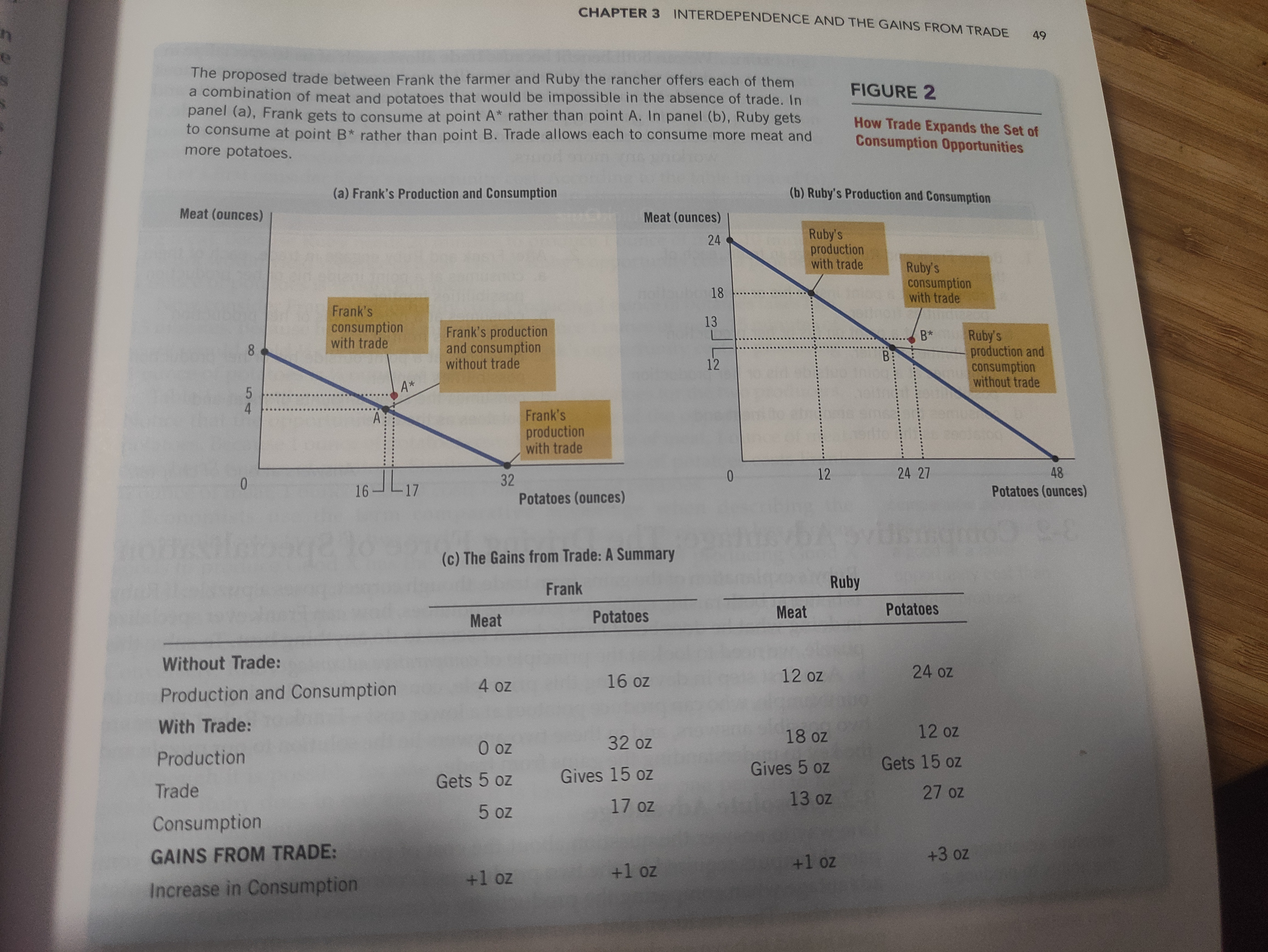

Absolute advantage: the ability to produce a good using fewer inputs than another producer

Opportunity cost: whatever must be given up to obtain some item

Comparative advantage: the ability to produce a good at a lower opportunity cost than another producer

For both parties to gain from trade, the price at which they trade must lie between their opportunity costs.

Chapter 4 The market Forces of Supply and Demand

Supply and demand determine prices in a market economy and how prices, in turn, allocate the economy's scarce resources.

Market a group of buyers and sellers of a particular good or service

Competitive market a market in which there are many buyers and many sellers so that each has a negligible impact on the market price

Some markets have only one seller, and this seller sets the price. Such a market is called a monopoly.

Quantity demand the amount of a good that buyers are willing and able to purchase.

Law of demand the claim that, other things being equal, the quantity demanded of a good falls when the price of the good rises

Demand schedule A table that shows the relationship between the price of a good and the quantity demanded

Demand curve A graph of the relationship between the price of a good and the quantity demanded

Normal good a good for which, other things being equal, an increase in income leads to an increase in demand

Inferior good a good for which, other things being equal, an increase in income leads to a decrease in demand (e.g. bus ride)

Substitute two goods for which an increase in the price of one leads to an increase in the demand for the other

Complements two goods for which an increase in the price of one leads to a decrease in the demand for the other

Shift demand curve / Move along the demand curve

Quantity supplied the amount of a good that sellers are willing and able to sell

Law of supply the claim that, other things being equal, the quantity supplied of a good rises when the price of the good rises

Supply schedule a table that shows the relationship between the price of a good and the quantity supplied.

Things that shift the supply curve: Input prices, Technology, Expectations, Number of sellers

Equilibrium a situation in which the market price has reached the level at which quantity supplied equals quantity demanded

Equilibrium price and Equilibrium quantity

Surplus above, shortage below

Chapter 5: Elasticity and its application

Elasticity: A measure of the responsiveness of quantity demanded or quantity supplied to a change in one of its determinants

Price elasticity of demand A measure of how much the quantity demanded of a good responds to a change in the price of that good, computed as the percentage change in quantity demanded divided by the percentage change in price.

Price Elasticity of demand = Percentage change in quantity demanded / Percentage change in price

Midpoint Mechod:

Inelastic The quantity demanded responds only slightly to changes in the price

Close substitutes: A good with close substitutes tends to have more elastic demand (e.g. Eggs, no substitute, less elastic than butter)

Necessities v. Luxuries: Inelastic v. Elastic

Time Horizons: Goods tend to have more elastic demand over longer time horizons. (e.g. Price of gasoline rise, people buy electric cars, gasoline demand falls substantially)

Revenue = P X Q

Income Elasticity of demand = Percentage change in quantity demanded / Percentage change in income

A measure of how much the quantity demanded of a good responds to a change in consumers' income, computed as the percentage change in quantity demanded divided by the percentage change in income.

Cross-price Elasticity of demand = Percentage change in quantity demanded of good one / Percentage change in the price of good two

A measure of how much the quantity demanded of one good responds to a change in the price of another good, computed as the percentage change in quantity demanded of the first good divided by the percentage change in price of the second good

Price Elasticity of supply A measure of how much the quantity supplied of a good responds to a change in the price of that good

Applications:

- Good news for farming, bad news for farmers

- OPEC fail to keep the price of oil high

- Drug interdiction: increase drug-related crime in the short run but decrease it in the long run

Chapter 6: Supply, Demand, and Government Policies

Economists have two roles. As scientists, they develop and test theories to explain the world around them. As policy advisers, they use these theories to help change the world for the better.

Controls on Prices

Price ceiling: A legal maximum on the price at which a good can be sold

Price floor: A legal minimum on the price at which a good can be sold

Minimum wage

There is some debate about the effects of minumum wages, the typical study finds that a 10 percent increase in the minimun wage depresses teenage employment by 1 to 3 percent.

Advocates: One way to raise the income of the working poor.

Opponents: It is not the best way to combat poverty, and causes unemployment.

With elastic demand and inelastic supply, the burden of luxury tax falls largely on the suppliers.

Chapter 7: Consumers, Producers, and the Efficiency of Markets.

Positive(what is) rather than normative(what should be)

Welfare economics the study of how the allocation of resources affects economics well-being

Willingness to pay The maximu amount that a buyer will pay for a good

Consumer surplus is the amount a buyer is willing to pay for a good minus the amount the buyer actually pays for it.

Consumer surplus measures the benefit buyers receive from partiipating in a market.

Producer surplus

Cost: The value of everything a seller must give up to produce a good

Producer surplus: the mount a seller is paid for a good minus the seller's cost of providing it

Marginal seller: The seller who would leave the market first if the price were any lower.

Total surplus = Value to buyers - cost to sellers.

Efficiency the property of a resource allocation of maximizing the total surplus received by all members of society.

Equality the property of distributing economic prosperity uniformly amoung the members of society.

Laissez-faire - leave to do

Many economists belive that allowing a free market for organs would yield large benefits. People are born with two kidneys, but they usually need only one.

Chapter 8: Application: The costs of taxation

Deadweight loss The fall in total surplus that results from a market distortion, such as a tax

Taxes cause deadweight losses because they prevent buyers and sellers from realizing some of the gains from trade.

The greater the elasticities of supply and demand, the larger the daedweight loss of a tax.

Labor taxes encourage workers to work fewer hours, second earners to stay at home, the elderly to retire early, and the unscrupulous to enter the underground economy.

Chapter 9: Application: International Trade

World price: The price of a good that prevails in the world market for that good.

Comparing the world price with the domestic price before trade reveals whether a country has a comparative advantage in producing the product.

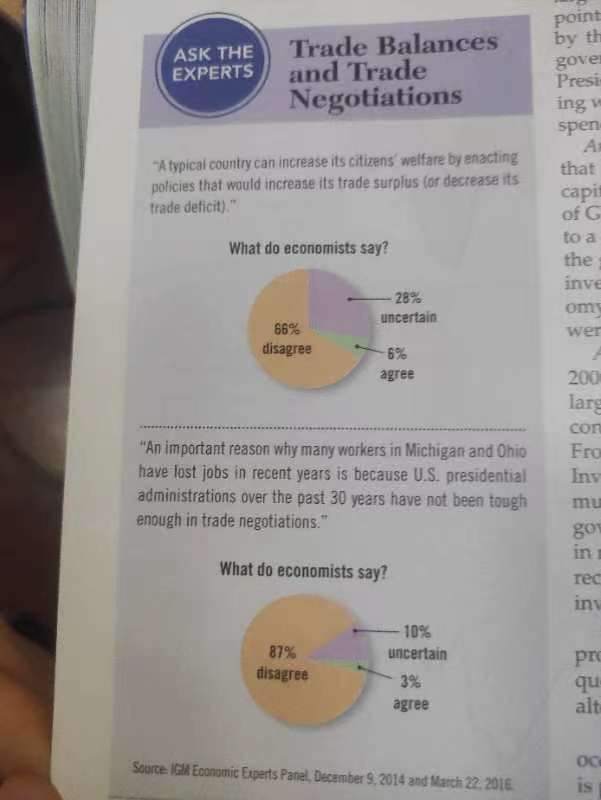

Trade among nations is ultimately based on comparative advantage.

Gains and losses of an exporting country:

- Allows trade, become an exporter of a good, domestic producers better off, domestic consumers are worse off.

- Raises the economic well-being of a nation in the sense that the gains of the winners exceed the losses of the losers.

Gains and losses of an importing country:

- domestic consumers better off, domestic producers are worse off.

Tariff a tax on goods produced abroad and sold domestically

The tariff reduces the quantity of imports and moves the domestic market closer to its equilibrium without trade

Tariff causes a deadweight loss because a tariff is a type of tax.

The benefits of international trade

Increased variety of goods

Lower costs through economies of scale

Increased competition

Increased productivity

Enhanced flow of ideas

Arguments

Jobs going abroad

National security

Infant-industries

Unfair competition

Chapter 10: Externalities

Externality the uncompensated impact of one person's actions on the well-being of a bystander

Adverse: negative externality Beneficial: positive externality

Steel factories' pollution

Internalizing the externality: altering incentives so that people take into account the external effects of their actions.

e.g. Taxes per ton of steel produced

Positive externalities: education, technology spillover(the impact of one firm's research and production efforts on other firms' access to technological advance)

Internalizing the externality: patent protection

Gasoline tax: congestion, accident, pollution

Selling pollution permits vs. corrective tax:

Government doesn't know what size tax would hit the target

Solution: auction off 600 unit pollution permits.

Coase theorem The proposition that if private parties can bargain without cost over the allocation of resources, they can solve the problem of externalities on their own.

Transaction costs The costs that parties incur during the process of agreeing to and following through on a bargain.

Chapter 11: Public goods and common resources

The markets work well if the good is ice cream but not if the good is clean air.

Excludability: The property of a good whereby a person can be prevented from using it.

Rivalry in consumption: The property of a good whereby one person's use diminishes other people's use.

Four categories:

Private goods: goods that are both excludable and rival in consumption

Public goods: goods that are neither excludable nor rival in consumption

Common resources: goods that are rival in consumption but not excludable

Club goods: goods that are excludable but not rival in consumption

Free rider: A person who receives the benefit of a good but avoids paying for it

Fireworks: externality

Important Public goods:

- National defense

- Basic research

- Fighting poverty

Lighthouses: public(operated by government) vs private(operated by the port)

Cost-benefit analysis a study that compares the costs and benefits to society of providing a public good

Tragedy of the commons

Shepherds allow the sheep population to grow so large that it destroys the Town Common.

Important common resources:

- Clean air and water

- Congested roads

- Fish, whales, other wildlife

In each case, the market fails to allocate resources efficiently because property rights are not well established.

Chapter 12: The design of the Tax system

Personal Income Taxes

Wages from working, interest on savings, dividends from corporations

Largest source of revenue for the federal government

marginal tax rate: The tax rate applied to each additional dollar of income.

Payroll taxes

Payroll tax is a tax on the wages that a firm pays its workers.

Corporate income taxes

Other taxes

Excise taxes 消费税

Deadweight loss

If the government taxes labor earnings, people work less and enjoy more leisure.

Administrative burden

Many taxpaters in higher tax brackets hire tax lawyers and accountants to help them with their taxes.

Marginal vs Average tax rates

Average tax rate: total taxes paid divided by total income

Marginal tax rate: The amount by which taxes increase from an additional dollar of income

Lump-sum tax: A tax that is the same amount for every person

Benefits principle

The idea that people should pay taxes based on the benefits they receive from government services

Ability-to-pay principle

The idea that taxes should be levied on a person according to how well that person can shoulder the burden

Vertical equity

The idea that taxpayers with a greater ability to pay taxes should pay larger amounts

Horizontal equity

The idea that taxpayers with similar abilities to pay taxes should pay the same amount

e.g. Family's ability to pay

Proportional

A tax for which high-income and low-income taxpayers pay the same fraction of income

Regressive

A tax for which high-income taxpayers pay a smaller fraction of their income than do low-income taxpayers

Progressive

A tax for which high-income taxpayers pay a larger fraction of their income than do low-income taxpayers

Conclusion

Trade off between Equity and Efficiency

Chapter 13: The costs of production

Total revenue: The amount a firm receives for the sale of its output

Total cost: The market value of the inputs a firm uses in production

Profit: Total revenue minus total cost

Profit = Total revenue - Total cost

Opportunity costs

Explicit costs: Input costs that require an outlay of money by the firm

Implicit costs: Input costs that do not require an outlay of money by the firm

cost of capital:

比如Chloe 有30万,投资了一间饼干厂。如果她把30万存银行,那么每年能拿1.5万的利息,这1.5万的利息也属于机会成本的一部分。

Economic profit: Total revenue minus total cost, including both explicit and implicit costs

Accounting profit: Total revenue minus total explicit cost

Production function:

The relationship between the quantity of inputs used to make a good and the quantity of output of that good

Marginal product

The increase in output that arises from an additional unit of input

Diminishing marginal product

The property whereby the marginal product of an input declines as the quantity of the input increases

Fixed and Variable cost

Fixed costs costs that do not vary with the quantity of output produced

Variable costs costs that vary with the quantity of output produced

Average total cost Total cost divided by the quantity of output

Average fixed cost Fixed cost divided by the quantity of output

Average variable cost Variable cost divided by the quantity of output

Marginal cost The increase in total cost that arises from an extra unit of production

Average total cost = Total cost / Quantity

ATC = TC/Q

Marginal cost = Change in total cost / Change in quantity

MC = TC/Q

Efficient Scale: The quantity of output that minimizes average total cost

Economies of scale The property whereby long-run average total cost falls as the quantity of output increases

Diseconomies of scale The property whereby long-run average total cost rises as the quantity of output increases

Constant returns to scale The property whereby long-run average total cost stays the same as the quantity of output increases

Chapter 14: Firms in Competitive Markets

Competitive market A market with many buyers and sellers trading identical products so that each buyer and seller is a price taker

perfectly competitive market

- There are many buyers and many sellers in the market

- The goods offered by the various sellers are largely the same

- Firms can freely enter or exit the market

Average revenue Total revenue divided by the quantity sold

Marginal revenue The change in total revenue from an additional unit sold

Marginal revenue vs Marginal cost:

Greater: increase output

Less: decrease output

Short-run decision to shut down

Shut down if TR < VC

Shutdown if P < AVC (price < Average variable cost)

Sunk cost A cost that has already been committed and cannot be recovered

Exit if P < ATC

Chapter 15: Monopoly

A competitive firm is a price taker, a monopoly firm is a price maker

Monopoly

A firm that is the sole seller of a product without any close substitutes

High price reduces the quantity that its customers buy, the monopoly's profits are not limited

- Monopoly resources: A key resource required for production is owned by a single firm.

- Government regulation: The government gives a single firm the exclusive right to produce some good or service.

- The production process: A single firm can produce output at a lower cost than can a larger number of firms.

Natural monopoly a type of monopoly that arises because a single firm can supply a good or service to an entire market at a lower cost than could two or more firms.

As the market expands, a natural monopoly can evolve into a more competitive market.

A monopolist's marginal revenue is less than the price of its good.

Profit = (P-ATC) x Q (price - average total cost) * quantity

No supply curve

The monopolist produces less than the socially efficient quantity of output.

Deadweight loss, inefficient

Price discrimination The business practice of selling the same good at different prices to different customers

Price discrimination is a rational strategy for a profit-maximizing monopolist.

Price discrimination requires the ability to separate customers according to their willingness to pay.

Arbitrage the process of buying a good in one market a t a low price and selling it in another market at a higher price

Coupons Companies know that not all customers are willing to spend time clipping coupons.

Impression Products Inc v. Lexmark: reimported goods

Antitrust laws

Traditionally, the courts are especially wary of horizontal mergers, which are mergers between two firms in the same market, like Coca-Cola and PepsiCo.

They are less likely to block vertical mergers, which are mergers between firms at different stages of the production process.

Regulation

Taxation: deadweight losses, unwilling to lower cost

Chapter 16: Monopolistic Competition

Example: market for novels

Oligopoly: A market structure in which only a few sellers offer similar or identical products

Monopolistic Competition: A market structure in which many firms sell products that are similar but not identical

- Many sellers: There are many firms competing for the same group of customers.

- Product differentiation: Each firm produces a product that is at least slightly different from those of other firms. Thus, rather than being a price taker, each firm faces a downward-sloping demand curve.

- Free entry and exit: Firms can enter and exit the market without restriction. Thus, the number of firms in the market adjusts until economic profits are driven to zero.

No clear cut

Short run:

Long run:

- The product-variety externality: Because consumers get some consumer surplus from the introduction of a new product, the entry of a new firm confers a positive externality on consumers.

- The business-stealing externality: Because other firms lose customers and profits when faced with a new competitor, the entry of a new firm imposes a negative externality on existing firms.

Advertising

Critics:

- Impedes competition

- Promotes irrational brand loyalty

- Manipulate people's tastes

Defense

- Provide information

- Foster competition

- Establishes brand names of reliable quality

Brand names

Critics:

- Cause consumer to perceive differences that do not really exist.

Defense

- Ensure the goods they buy are of high quality.

Chapter 17: Oligopoly

Tennis: Penn, Wilson, Prince, Dunlop

Oligopoly: A market structure in which only a few sellers offer similar or identical products

Game theory: The study of how people behave in strategic situations

Collusion: An agreement among firms in a market about quantities to produce or prices to charge

Cartel: A group of firms acting in unison

Nash equilibrium: A situation in which economic actors interacting with one another each choose their best strategy given the strategies that all the other actors have chosen.

The output effect: Because price is above marginal cost, selling one more gallon of water at the going price will raise profit.

The price effect: Raising production will increase the total amount sold, which will lower the price of water and lower the profit from all the other gallons sold.

Prisoners' dilemma A particular "game" between two captured prisoners that illustrates why cooperation is difficult to maintain even when it is mutually beneficial

Dominant strategy: A strategy that is best for a player in a game regardless of the strategies chosen by the other players.

Examples: OPEC, Arms Races

Controversies:

Business practices that appear to reduce competition may in fact have legitimate purposes.

Predatory pricing: Intended price cuts to drive opponents out of market

Tying: bundling products

Chapter 18: The Markets for the Factors of Production

Factors of production: the inputs used to produce goods and services

Labor, land and capital are the three most important factors of production.

derived demand 派生需求

production function: the relationship between the quantity of inputs used to make a good and the quantity of output of that good

Marginal product of labor: the increase in the amount of output from an additional unit of labor

Diminishing marginal product: the property whereby the marginal product of an input declines as the quantity of the input increases.

Value of the marginal product: The marginal product of an input times the price of the output

Labor demand curve shift:

- Output price

- Technological change

- Supply of other factors

- Changes in tastes

- Changes in alternative opportunities

- Immigration

Both theory and history confirm the close connection between productivity and real wages.

Capital: the equipment and structures used to produce goods and services

An event that changes the supply of any factor of production can alter the earnings of all the factors.

Black Death: Wages approximately doubled, economic prosperity

Chapter 19: Earnings and Discrimination

Compensating Differential: a difference in wages that arises to offset the nonmonetary characteristics of different jobs.

Human Capital: The accumulation of investments in people, such as education and on-the-job training

skill-biased technological change

Superstar phenomenon

- Every customer in the market wants to enjoy the good supplied by the best producer

- The good is produced with a technology that makes it possible for the best producer to supply every customer at low cost.

e.g. Film star, sports figure

Union: A worker association that bargains with employees over wages and working conditions

Strike: The organized withdrawal of labor from a firm by a union

Efficiency wages: Above-equilibrium wages paid by firms to increase worker productivity

Discrimination: The offering of different opportunities to similar individuals who differ only by race, ethnic group, sex, age or other personal characteristics.

Statistical discrimination: Discrimination that arises because an irrelevant but observable personal characteristic is correlated with a relevant but unobservable attribute

Chapter 20: Income Inequality and Poverty

The inherent vice of capitalism is the unequal sharing of blessings. The inherent virtue of socialism is the equal sharing of miseries.

-- Winston Churchill

Poverty rate: The percentage of the population whose family income falls below an absolute level called the poverty line

Poverty line: An absolute level of income set by the federal government for each family size below which a family is deemed to be in poverty

American Poverty correlated with:

- Race

- Age

- Family composition

In-kind transfers: Transfers to the poor given in the form of goods and services rather than cash

Standard measurements of the degree of inequality exclude these in-kind transfers.

The inherent vice of capitalism is the unequal sharing of blessings. The inherent virtue of socialism is the equal sharing of miseries.

Life cycle: The regular pattern of income variation over a person's life

In school: low income, Rises as worker gains maturity and experience, peaks at around 50, then falls

Permanent income: A person's normal income

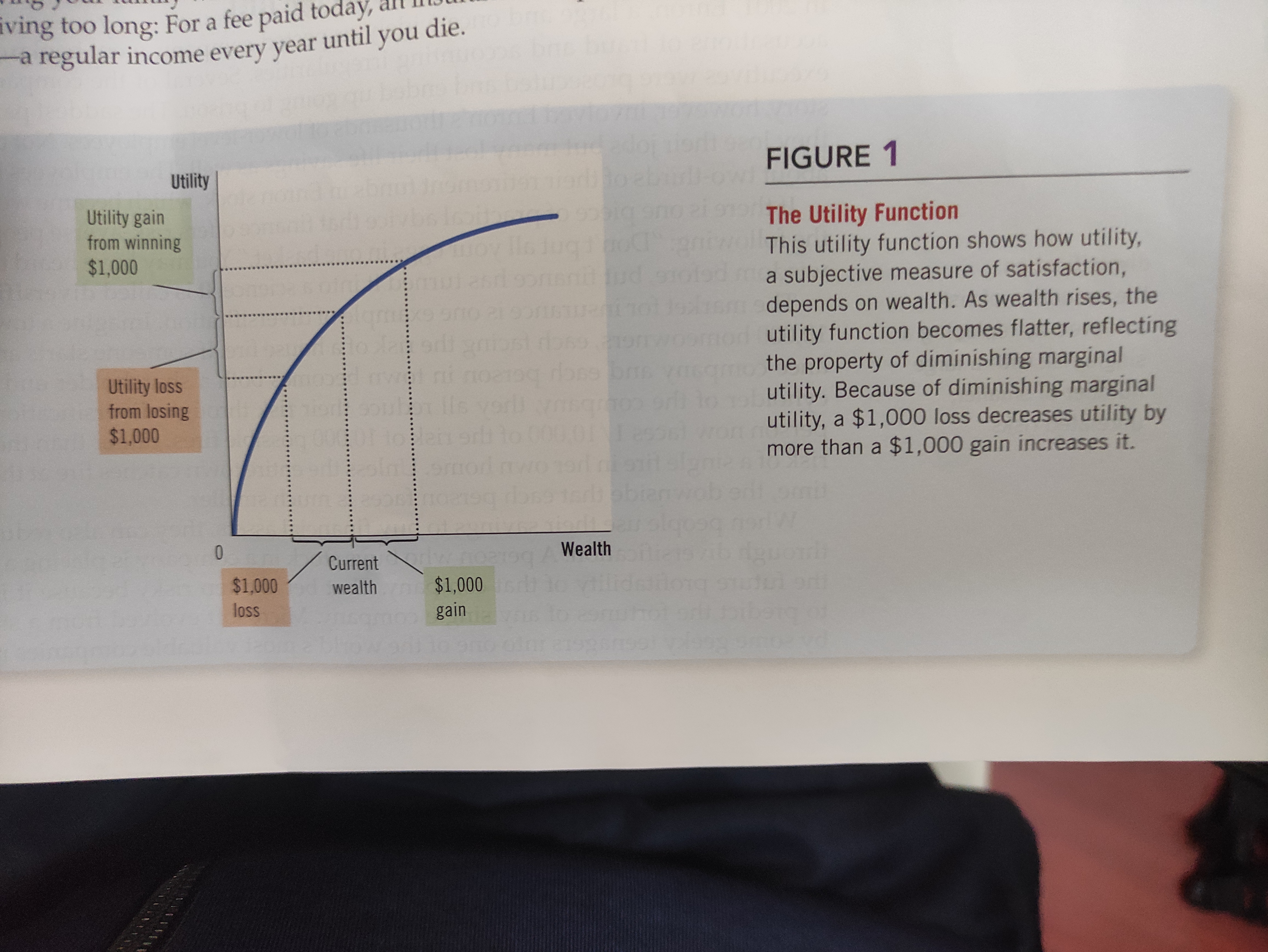

Utilitarianism: The political philosophy according to which the government should choose policies to maximize the total utility of everyone in society.

Utility: A measure of happiness or satisfaction

With only a leaky bucket at its proposal, a utilitarian government will stop short of trying to reach full equality.

Liberalism: The political philosophy according to which the government should choose policies deemed just, as evaluated by an impartial observer behind a "veil of ignorance"

"A theory of justice" - John Rawls

Original position behind a veil of ignorance

Rather than maximizing the sum of everyone's utility as a utilitarian would, Rawls would strive to maximize the minimun utility. Maximin criterion

Social insurance: Government policy aimed at protecting people against the risk of adverse events.

Libertarianism: The political philosophy according to which the government should punish crimes and enforce voluntary agreements but not redistribute income.

Equality of opportunities is more important than equality of outcomes.

Welfare government programs that supplement the incomes of the needy

Negative income tax a tax system that collects revenue from high-income households and gives subsidies to low-income households

e.g. Tax = income - $15000

Unintended effects:

- Discourage the poor from escaping poverty

Chapter 21: The theory of consumer choice

Budget constraint: The limit on the consumption bundles that a consumer can affort

Indifference curve A curve that shows consumption bundles that give the consumer the same level of satisfaction

Marginal rate of substitution: The rate at which a consumer is willing to trade one good for another

Perfect substitutes: Two goods with straight-line indifference curves

e.g. Trade 2 nickels for 1 dime, MRS = 2

Perfect complements: Two goods with right-angle indifference curves

e.g. Left shoe and right shoe

Consumer's optimum: Marginal rate of substitution equals the relative price.(Tangent)

Normal good: A good for which an increase in income raises the quantity demanded

Inferior good: A good for which an increase in income reduces the quantity demanded

Income effect: The change in consumption that results when a price change moves the consumer to a higher or lower indifference curve

Substitution effect: The change in consumption that results when a price change moves the consumer along a given indifference curve to a point with a new marginal rate of substitution.

Giffen good: A good for which an increase in the price raises the quantity demanded

Chapter 22: Frontiers of Microeconomics

Information Asymmetry

Moral hazard: The tendency of a person who is imperfectly monitored to engage in dishonest or otherwise undesirable behavior

Agent: a person who performs an act for another person, called the principal

Principal A person for whom another person, called the agent, performs some act

A worker who earns an above-equilibrium wage is less likely to shirk because if he is caught and fired, he might not be able to find another high-paying job.

Adverse selection: The tendency for the mix of unobserved attributes to become undesirable from the standpoint of an uninformed party.

e.g. Used car market: surmise that the seller knows something about it that the buyer does not.

Signaling: an action taken by an informed party to reveal private information to an uninformed party.

Screening: an action taken by an uninformed party to induce an informed party to reveal information

Political economy: the study of government using the analytic methods of economics

Condorcet paradox: The failure of majority rule to produce transitive preferences for society

Arrow's impossibility theorem

- Unanimity: If everyone prefers A to B, then A should beat B.

- Transitivity: If A beats B, and B beats C, then A should beat C.

- Independence of irrelevant alternatives: The ranking between any two outcomes A and B should not depend on whether some third outcome C is also available

- No dictators: There is no person who always gets his way, regardless of everyone else's preferences

No voting system can satisfy all these properties

Median voter theorem: A mathematical result showing that if voters are choosing a point along a line and each voter wants the point closest to his most preferred point, then majority rule will pick the most preferred point of the median voter.

Behavioral economics: The subfield of economics that integrates the insights of psychology.

Satisficers rather than rational maximizers

- People are over confident

- People give too much weight to a small number of vivid observations

- People are reluctant to change their minds(confirmation bias)

People are driven in part by some innate sense of fairness.

People are inconsistent over time.

Chapter 23: Measuring a Nation's Income

Microeconomics: The study of how households and firms make decisions and how they interact in markets

Macroeconomics: The study of economy-wide phenomena, including inflation, unemployment, and economic growth.

GDP Gross Domestic Product:The market value of all final goods and services produced within a country in a given period of time.

GDP measures two things at once: the total income of everyone in the economy and the total expenditure on the economy's output of goods and services.

For an economy as a whole, income must equal expenditure.

Paradoxical results: mow lawn, before/after marriage

Final product: no intermediate good

Goods and services: tangible goods and intangible services

Chapter 24: Measuring the cost of living

Consumer Price Index(CPI): A measure of the overall cost of the goods and services bought by a typical consumer.

Fix the basket - determine which prices are most important

Find the prices

Conpute the basket's cost

Choose a base year and compute the index

CPI = Price of basket this year / Price of basket in base year

Inflation rate: The percentage change in the price index from the preceding period

Inflation rate = (CPI~x+1~ - CPI~x~) / CPI~x~

Core CPI: A measure of the overall cost of consumer goods and services excluding food and energy

Producer Price Index(PPI): A measure of the cost of a basket of goods and services bought by firms

Changes in the PPI are often thought to be useful for predicting changes in the CPI

Problem:

Substitution bias: Buying less of the goods whose prices have risen by large amounts and buying more of the goods whose prices have risen less and perhaps even have fallen. Overstate

Introduction of new goods

Unmeasured quality change

GDP deflator vs CPI:

All goods and services produced domestically vs

All goods and services bought by consumers

Amount in today's dollars = Amount in year T dollars * Price level today / Price level in year T

Indexation: The automatic correction by law or contract of a dollar amount for the effects of inflation

Nominal interest rate: The interest rate as usually reported without a correction for the effects of inflation

Real interest rate: The interest rate corrected for the effects of inflation

Because inflation is variable, real and nominal interest rates do not always move together.

Chapter 25: Production and Growth

Productivity: The quantity of goods and services produced from each unit of labor input

Like Robinson Crusoe, a nation can enjoy a high standard of living only if it can produce a large quantity of goods and services.

Physical capital: The stock of equipment and structures that are used to produce goods and services

Knowledge capital: The knowledge and skills acquire through education, training, and experience.

Natural resources: The inputs into the production of goods and services that are provided by nature, such as land, rivers, and mineral deposits.

Technological Knowledge: Society's understanding of the best ways to produce goods and services

Diminishing returns: The property whereby the benefit from an extra unit of an input declines as the quantity of the input increases.

e.g. Increasing the capital per worker

Catch-up effect: The property whereby countries that start off poor tend to grow more rapidly than countries that start off rich.

Foreign direct investment: A capital investment that is owned and operated by a foreign entity

Foreign portfolio investment: An investment financed with foreign money but operated by domestic residents

Problem facing some poor countries: Brain drain - The emigration of many of the most highly educated workers to rich countries, where these workers can enjoy a higher standard of living.

Human capital also includes: health and nutrition

An important prerequisite for the price system to work is an economy-wide respect for property right.

Chapter 26: Saving, Investment, and the Financial System

Financial system: the group of institutions in the economy that help to match one person's saving with another person's investment

Financial markets: financial institutions through which savers can directly provide funds to borrowers.

Bond: a certificate of indebtedness

Date of maturity: The time at which the loan will be repaid

principal 面额

Stock: a claim to partial ownership in a firm

Financial intermediaries: Financial institutions through which savers can indirectly provide funds to borrowers

e.g. Banks, mutual fund

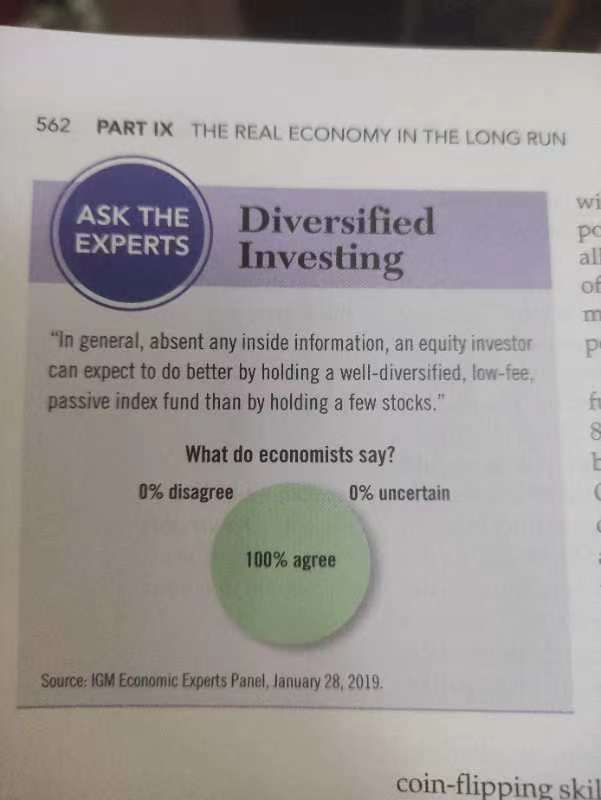

Mutual fund: An institution that sells shares to the public and uses the proceeds to buy a portfolio of stocks and bonds

National saving: The total income in the economy that remains after paying for consumption and government purchases (= Y-C-G)

Y = C + I + G + NX

For a closed economy:

Y = C + I + G

Private saving: The income that households have left after paying for taxes and consumption

Public saving: The tax revenue that the government has left after paying for its spending

Budget surplus: An excess of tax revenue over government spending

Budget deficit: A shortfall of tax revenue from government spending

Market for loanable funds: The market in which those who want to save supply funds and those who want to borrow to invest demand funds

Crowd out: A decrease in investment that results from government borrowing

When the government reduces national saving by running a budget deficit, the interest rate rises and investment falls.

Chapter 27: The Basic tools of Finance

Finance: the field that studies how people make decisions regarding the allocation of resources over time and the handling of risk.

Present value: the amount of money today needed to produce a future amount of money, given prevailing interest rates

Future value: the amount of money in the future that an amount of money today will yield, given prevailing interest rates

Compounding: The accumulation of a sum of money in, say, a bank account, where the interest earned remains in the account to earn additional interest in the future.

Risk averse: A dislike of uncertainty

The role of insurance is not to eliminate the risks inherent in life but to spread them around more efficiently.

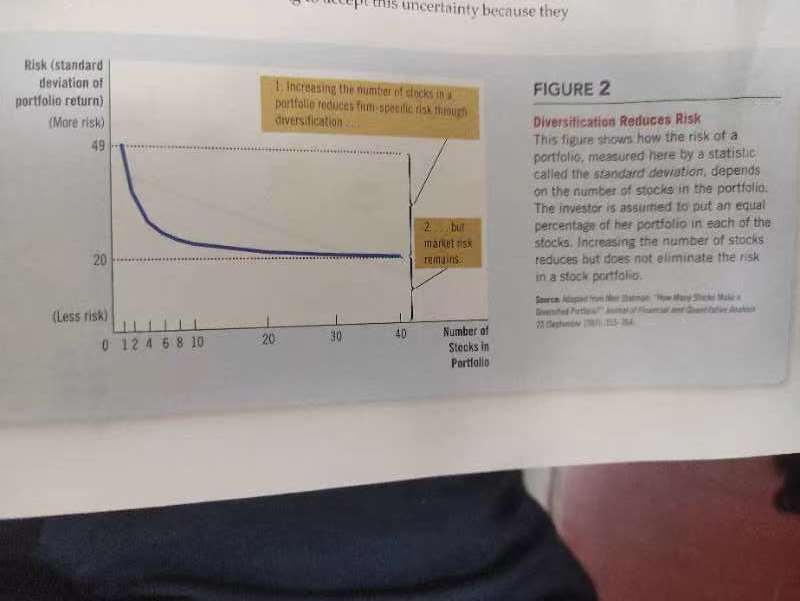

Diversification: The reduction of risk achieved by replacing a single risk with a large number of smaller, unrelated risks.

Firm-specific risk: Risk that affects only a single company

Market risk: Risk that affects all companies in the stock market

Fundamental analysis: the study of a company's accounting statements and future prospects to determine its value.

Efficient markets hypothesis: the theory that asset prices reflect all publicly available information about the value of an asset.

Informational Efficiency: The description of asset prices that rationally reflect all available information.

Random walk: The path of a variable whose changes are impossible to predict

News is inherently unpredictable--otherwise, it wouldn't really be news.

Chapter 28: Unemployment

Natural rate of unemployment: The amount of unemployment that the economy normally experiences

Cyclical unemployment: The year-to-year fluctuations in unemployment around its natural rate

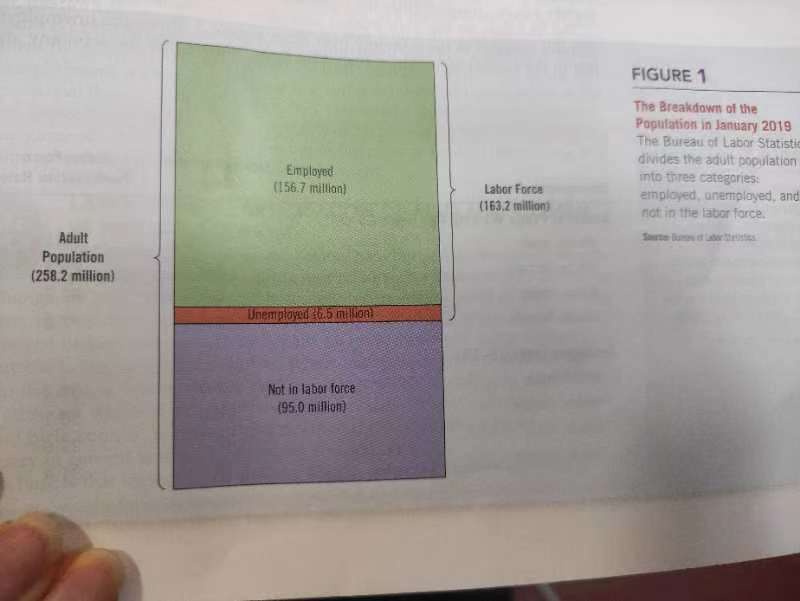

Employed: Those who worked as paid employees, worked in their own business, or worked as unpaid workers in a family member's business. Both full-time and part-time workers are counted.

Unemployed: Those who were not employed, were available for work, and had tried to find employment during the previous four weeks.

Not in the labor force: Those who fit neither of the first two categories

Labor force: The total number of workers, including both the employed and the unemployed

Labor force = Number of employed + Number of unemployed

Unemployment rate: The percentage of the labor force that is unemployed

Unemployment rate = Number of unemployed / Labor force * 100

Labor-force participation rate: The percentage of the adult population that is in the labor force

Labor-force participation rate = Labor force / Adult population * 100

Discouraged workers: Individuals who would like to work but have given up looking for a job

Frictional unemployment: Unemployment that results because it takes time for workers to search for the jobs that best suit their tastes and skills

Structural unemployment: Unemployment that results because the number of jobs available in some labor markets is insufficient to provide a job for everyone who wants one

Job search: The process by which workers find appropriate jobs given their tastes and skills

Unemployment insurance: A government program that partially protects the incomes of workers who become unemployed.

If the wage is kept above the equilibrium level for any reason, the result is unemployment

Union: a worker association that bargains with employers over wages, benefits, and working conditions.

Collective bargaining: The process by which unions and firms agree on the terms of employment

Strike: The organized withdrawal of labor from a firm by a union

Efficiency wages: above-equilibrium wages paid by firms to increase worker productivity

Chapter 29: The monetary system

Barter: The exchange of one good or service for another

Double coincidence of wants: The unlikely occurrence that two people each have a good or service that the other wants.

Money: The set of assets in an economy that people regularly use to buy goods and services from other people.

Medium of exchange: An item that buyers give to sellers when they want to purchase goods and services

Unit of account: The yardstick people use to post prices and record debts

Store of value: An item that people can use to transfer purchasing power from the present to the future.

Liquidity: The ease with which an asset can be converted into the economy's medium of exchange.

Commodity money: Money that takes the form of a commodity with intrinsic value

Fiat money: Money without intrinsic value that is used as money by government decree

Currency: The paper bills and coins in the hands of the public

Demand deposits: Balances in bank accounts that depositors can access on demand by writing a check

Federal reserve: The central bank of the United States

Central Bank: An institution designed to oversee the banking system and regulate the quantity of money in the economy

The lender of last resort 最后贷款者

A lender to those who cannot borrow anywhere else

Money supply: The quantity of money available in the economy

Monetary policy: The setting of the money supply by policymakers in the central bank

Reserves: Deposits that banks have received but have not loaned out

Fractional-reserve banking: A banking system in which banks hold only a fraction of deposits as reserves

Reserve ratio: The fraction of deposits that banks hold as reserves

Money multiplier: The amount of money the banking system generates with each dollar of reserves

Bank capital: The resources a bank's owners have put into the institution

Leverage: The use of borrowed money to supplement existing funds for purposes of investment

Leverage ratio: The ratio of assets to bank capital

Capital requirement: A government regulation specifying a minimum amount of bank capital

Open-market operations: The purchase and sale of U.S. government bonds by the Fed

Discount rate: The interest rate on the loans that the Fed makes to banks

Reserve requirements: Regulations on the minimum amount of reserves that banks must hold against deposits

Federal funds rate: The interest rate at which banks make overnight loans to one another

Chapter 30: Money growth and Inflation

18th century, David Hume, Quantity theory of money

1974 President Ford "Public enemy number one"

Classical Theory of Inflation

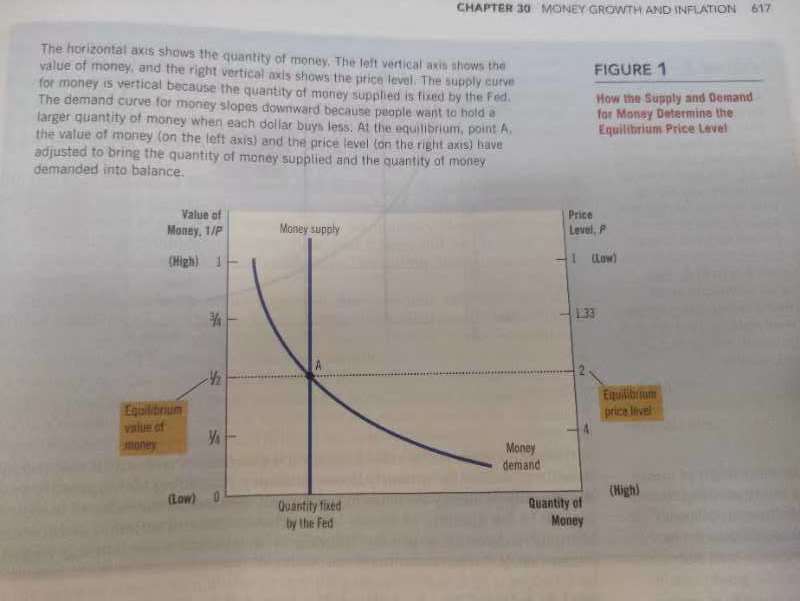

The supply and demand of money determines the value of money.

In the long run, the money supply and money demand are brought into equilibrium by the overall level of prices

Quantity theory of money: A theory asserting that the quantity of money available determines the price level and that the growth rate in the quantity of money available determines the inflation rate

Nominal variables: Variables measured in monetary units

Real variables: Variables measured in physical units

Classical dichotomy: The theoretical separation of nominal variables and real variables

Monetary neutrality: The proposition that changes in the money supply do not affect real variables

Velocity of money: The rate at which money changes hands

V = P * Y / M

Velocity = Price level(GDP deflator) * Quantity of output(Real GDP) / Supply of money

Quantity equation:

M*V = P*Y

Inflation tax: The revenue the government raises by creating money.

The inflation tax is like a tax on everyone who holds money

Fisher effect: The one-for-one adjustment of the nominal interest rate to the inflation rate

When the Fed increases the rate of money growth, the long-run result is both a higher inflation rate and a higher nominal interest rate

Inflation does not in itself reduce people's real purchasing power

Shoeleather costs: The resources wasted when inflation encourages people to reduce their money holdings

Menu costs: The costs of changing prices

Extra burden on Capital gains and Nominal interest income

Confusion and inconvenience

Chapter 31: Open-Economy Macroeconomics: Basic Concepts

Closed economy: An economy that does not interact with other economies in the world

Open economy: An economy that interacts freely with other economies around the world

The flow of goods

Net exports = Value of country's exports - Value of country's imports

Net capital outflow: The purchase of foreign assets by domestic residents minus the purchase of domestic assets by foreigners

For an economy as a whole, net capital outflow(NCO) must always equal net exports(NX)

S = I + NX = I + NCO

Saving = Domestic Investment + Net Capital Outflow

Once U.S. saving has declined, it is better to have foreigners invest in the U.S. economy than no one at all.

A trade deficit is not a problem in itself, but it can sometimes be a symptom of a problem.

Nominal exchange rate: The rate at which a person can trade the currency of one country for the currency of another

Appreciation: an increase in the value of a currency as measured by the amount of foreign currency it can buy

Depreciation: A decrease in the value of a currency as measured by the amount of foreign currency it can buy

Real exchange rate: The rate at which a person can trade the goods and services of one country for the goods and services of another

Real exchange rate = Nominal exchange rate * Price Index for a domestic basket / Price index for a foreign basket

Purchasing power parity: A theory of exchange rates whereby a unit of any given currency should be able to buy the same quantity of goods in all countries

The process of taking advantage of price differences for the same item in different markets is called arbitrage

Not completely accurate, reasons:

Many goods are not easily traded

e.g. Haircuts

Even tradable goods are not always perfect substitutes when they are produced in different countries.

Chapter 32: A Macroeconomics Theory of the Open Economy

At the equilibrium interest rate, the amount that people want to save exactly balances the desired quantities of domestic investment and net capital outflow.

Capital outflow does not depend on the exchange rate. Changes in the exchange rate influence both the cost of buying foreign assets and the benefit of owning them, and these two effects offset each other.

In an open economy, government budget deficits raise real interest rates, crowd out domestic investment, cause the currency to appreciate, and push the trade balance toward deficit

Trade policy: Government policy that directly influences the quantity of goods and services that a country imports or exports

Tariff: a tax on imported goods

Import quota: a limit on the quantity of a good produced abroad that can be sold domestically.

Capital flight: A large and sudden reduction in the demand for assets located in a country

Capital flight from Mexico increases Mexican interest rates and decreases the value of the Mexican peso in the market for foreign-currency exchange.

- Most job losses are not due to international trade.

- Trade is more about efficiency than about the number of jobs.

- Bilateral trade imbalances are inevitable and mostly uninteresting.

- Running an overall trade deficit does not make us "losers"

- Trade agreements barely affect a nation's trade balance.

Chapter 33: Aggregate Demand and Aggregate Supply

Recession: A period of declining real incomes and rising unemployment

Depression: A severe recession

Key facts about economic flucturations

- Economic Fluctuations are irregular and unpredictable

- Most Macroeconomic quantities fluctuate together

- As output falls, unemployment rises

Most economists believe that classical theory describes the world in the long run but not in the short run

Model of aggregate demand and aggregate supply: The model that most economists use to explain short-run fluctuations in economic activity around its long-run trend

Aggregate-demand curve: A curve that shows the quantity of goods and services that households, firms, government and customers abroad want to buy at each price level

Aggregate-supply curve: A curve that shows the quantity of goods and services that firms choose to produce and sell at each price level

The wealth effect: A decrease in the price level makes consumers wealthier, thereby encouraging them to spend more. The increase in consumer spending means a larger quantity of goods and services demanded.

In the long run, real GDP depends on its supplies of labor, capital, and natural resources and on the available technology used to turn these factors of production into goods and services.

Natural level of output: The production of goods and services that an economy achieves in the long run when unemployment is at its normal rate.

The sticky-wage theory: Nominal wages are slow to adjust to changing economic conditions.

The Sticky-Price Theory: Prices of some goods and services are slow to adjust to changing economic conditions.

The Misperceptions Theory: Changes in overall price level can temporarily mislead suppliers about what is happening in the market.

e.g. Wheat Farmers reduce production when they notice a fall in the price of wheat before they notice a fall in the prices of the many items they buy.

Stagflation: The economy experiencing both stagnation (falling output) and inflation (rising prices)

Wage-price spiral: The phenomenon of higher prices leading to higher wages, in turn leading to even higher prices

Chapter 34: The influence of Monetary and FIscal Policy on Aggregate demand

Theory of liquidity preference: Keynes's theory that the interest rate adjusts to bring money supply and money demand into balance

When the Fed increases the money supply, it lowers the interest rate and increases the quantity of goods and services demanded, shifting the aggregate-demand curve to the right

A liquidity trap is a contradictory economic situation in which interest rates are very low (e.g., close to 0%) and savings rates are high, rendering monetary policy ineffective

Automatic stabilizers: Changes in fiscal policy that stimulate aggregate demand when the economy goes into a recession but that occur without policymakers having to take any deliberate action

Chapter 35: The Short-run trade-off between inflation and unemployment

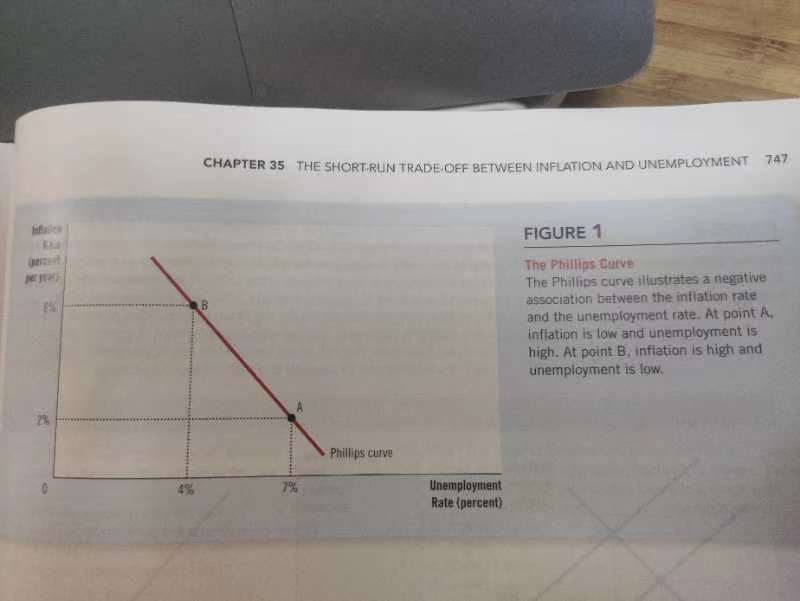

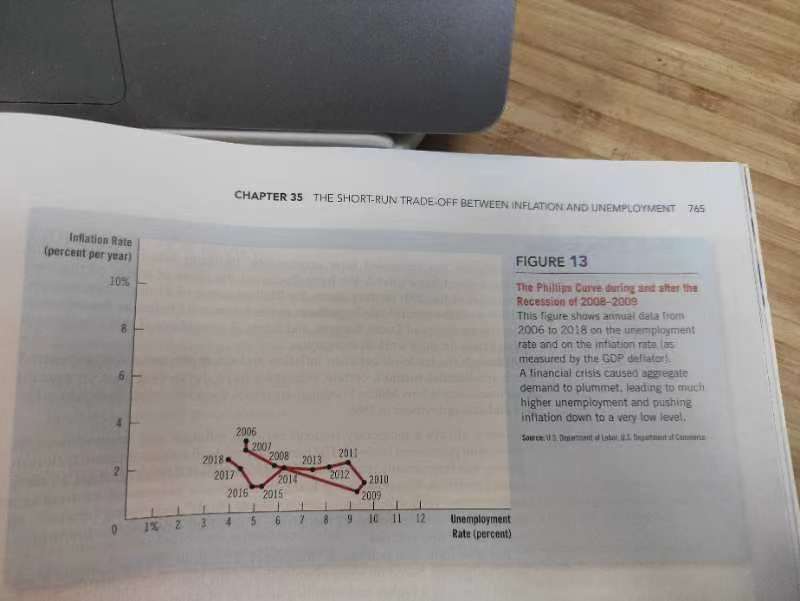

Philips curve: A curve that shows the short-run trade-off between inflation and unemployment

According to Friedman and Phelps, there is no trade-off between inflation and unemployment in the long run.

Natural-rate hypothesis: The claim that unemployment eventually returns to its normal, or natural, rate, regardless of the rate of inflation

Supply shock: An event that directly alters firms' costs and prices, shifting the economy's aggregate-supply curve and thus the Philips curve.

Sacrifice ratio: The number of percentage points of annual output lost in the process of reducing inflation by 1 percentage point

Rational expectations: The theory that people optimally use all the information they have, including information about government policies, when forecasting the future.

Chapter 36: Six Debates over Macroeconomic Policy

Should Monetary and Fiscal Policymakers try to stabilize economy?

Should the government fight recessions with spending hikes rather than tax cuts?

Should monetary policy be made by rules rather than by discretion?

Should the central bank aim for zero inflation?

Should the government balance its budget?

Should the tax law be reformed to encourage saving?

中文版本:

经济学原理

微观分册

第1章 经济学十大原理

经济学研究社会如何管理自己的稀缺资源。

效率与平等之间的选择

机会成本:得到一种东西必须放弃的东西

边际变动:对现有计划的微小增量调整。理性人比较边际效益与边际成本做决策。钻石 vs 水

激励(incentive)是引起一个人作出行动的某种东西

贸易可以使每个人状况变得更好

市场经济 vs 计划经济

产权、市场失灵(外部性:污染、福利影响等 市场势力:小群体不适当地影响价格的能力)

几乎所有的生活水平差别都可以归因于生产率差别

通货膨胀 vs 失业 取舍

Y = C + I + G + NX

Consumption + Investment + Government purchases + Net exports

Consumption: spending by households on goods and services, with the exception of purchases of new housing

Investment: spending on business capital, residential capital, and inventories

Not financial investments, purchase of goods that will be used to produce other goods and services in the future.

Government purchases Spending on goods and services by local, state, and federal governments

e.g. Salary of an Army general, school teacher

Tranfer payments(not government purchases): Unemployment insurance benefit, social security benefit, as they are not made in exchange for a currently produced good or service.

Net exports: spending on domestically produced goods by foreigners (exports) minus spending on foreign goods by domestic residents (imports)

Nominal GDP: The production of goods and services valued at current prices

Real GDP: The production of goods and services valued at constant prices

Designate one year as a base year.

GDP Deflator: a measure of the price level calculated as the ratio of nominal GDP to real GDP times 100

GDP Deflator = Nominal GDP / Real GDP * 100

Inflation rate in year 2 = (GDP deflator in year 2 - GDP deflator in year 1) / GDP deflator in year 1 * 100

宏观分册

第8章 一国收入的衡量

宏观经济学的目标是解释同时影响许多家庭、企业和市场的经济变化。

对一个经济而言,收入必定等于支出。

Y = C + I + G + NX

Y: GDP

C: 消费,物品与服务的支出(除买房外)

I: 投资,对用于未来生产更多物品与服务的物品(资本品)的购买。包括资本设备、存货和建筑物支出,包括新住房支出。

G: 政府投资,包括政府用于物品、服务的支出,员工薪水、公务支出。

NX: 净出口,外国对国内生产物品的支出减去国内对外国物品的支出。

真实GDP vs 名义GDP

GDP平减指数 = 名义GDP / 真实GDP